Outrageous Tips About How To Check Banks Stability

Credit ratings, research and analysis for the global financial markets people;

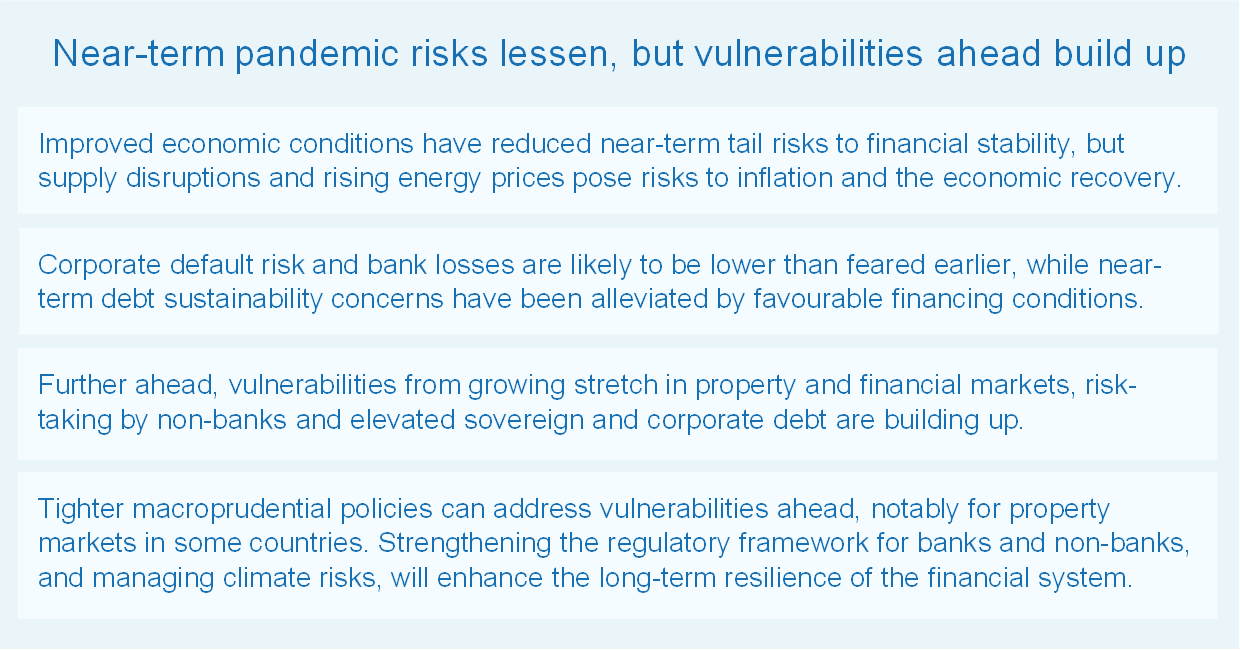

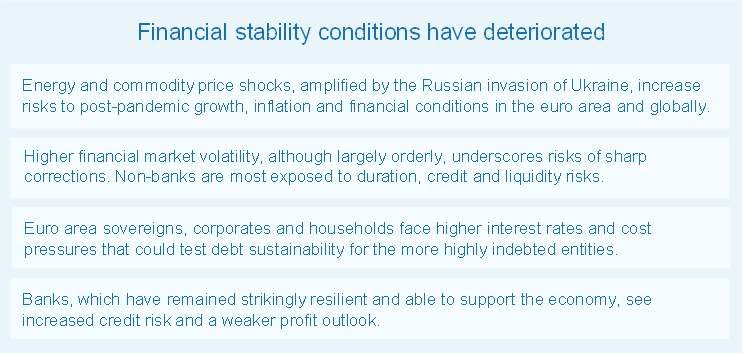

How to check banks stability. The bank offers savers options to earn interest on. A bank is well financially stable if it meets all payments upon it with its own or borrowed funds (ghassan & krichene, 2017). Online checking accounts stand out for different features.

Using the individual bank balance sheet data described in section 2, we define l it as the value of liquid assets of bank i at quarter t. The federal savings bank specializes in mortgages for homebuyers, but also offers deposit products and personal loans. First, select bank rating or credit union rating, then… select a state.

Length of credit history, credit utilization, debt repayment, and so on, are all statistics which you should be aware of. This ratio attempts to determine how much capital a bank has in order to cover loan losses. 6 min read sep 01, 2022.

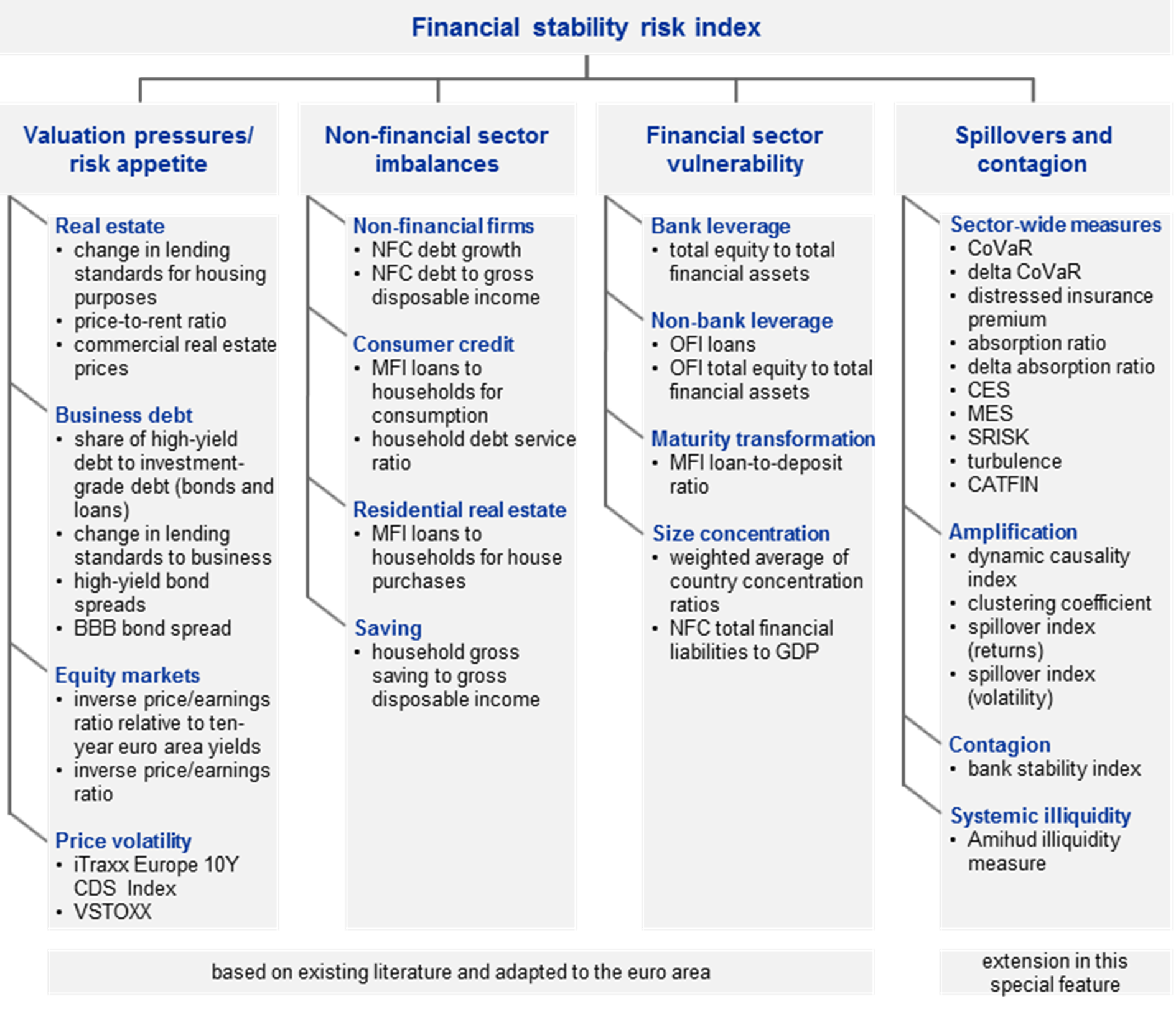

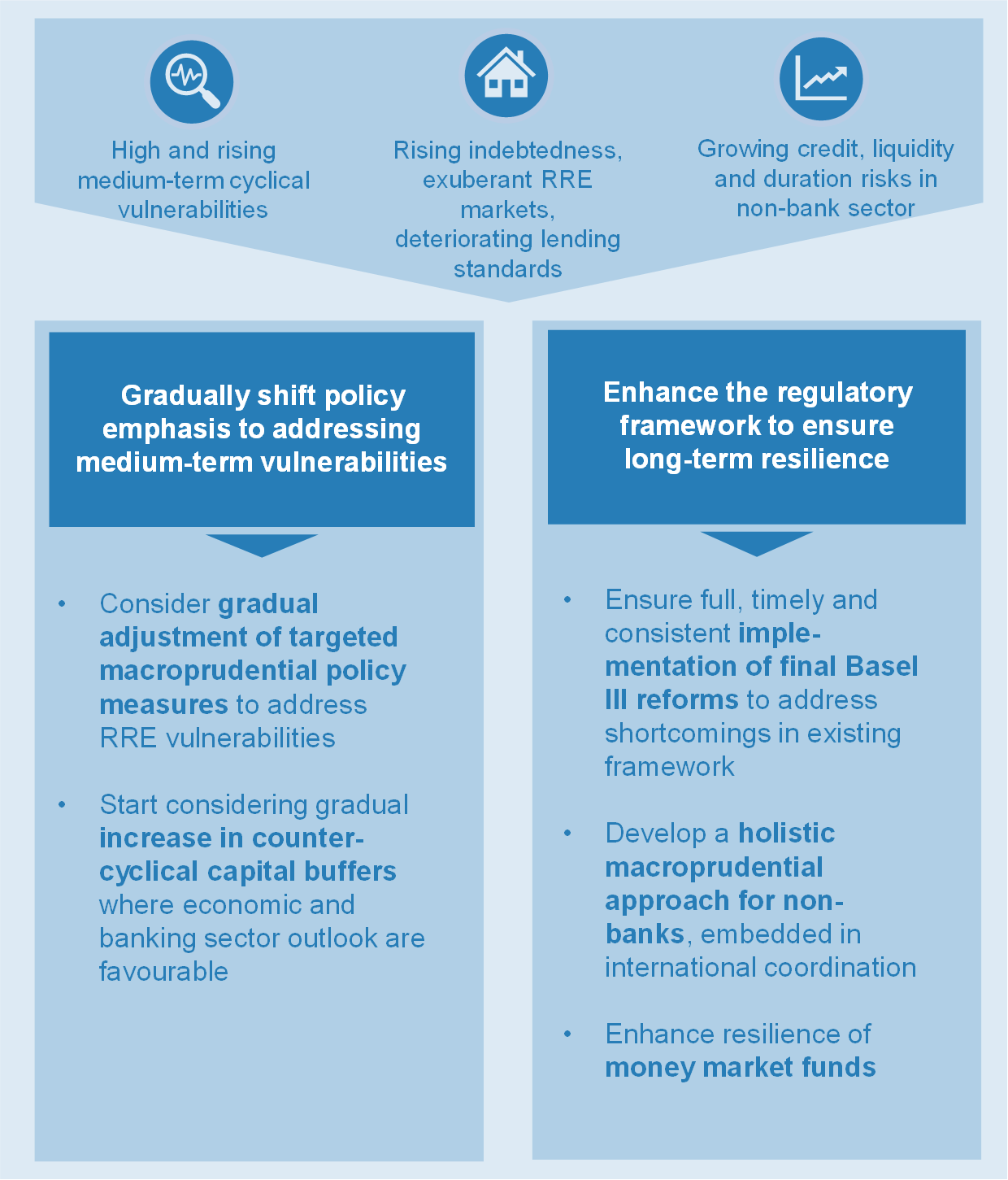

You can also check for signs such as declining deposits for the current year over last year by looking up your bank on the fdic website. Factors leading to bank stability (or risk of instability) included in this protocol are: Bauerfinancial includes ratings on credit unions, and you can search by typing in the name of your financial institution.

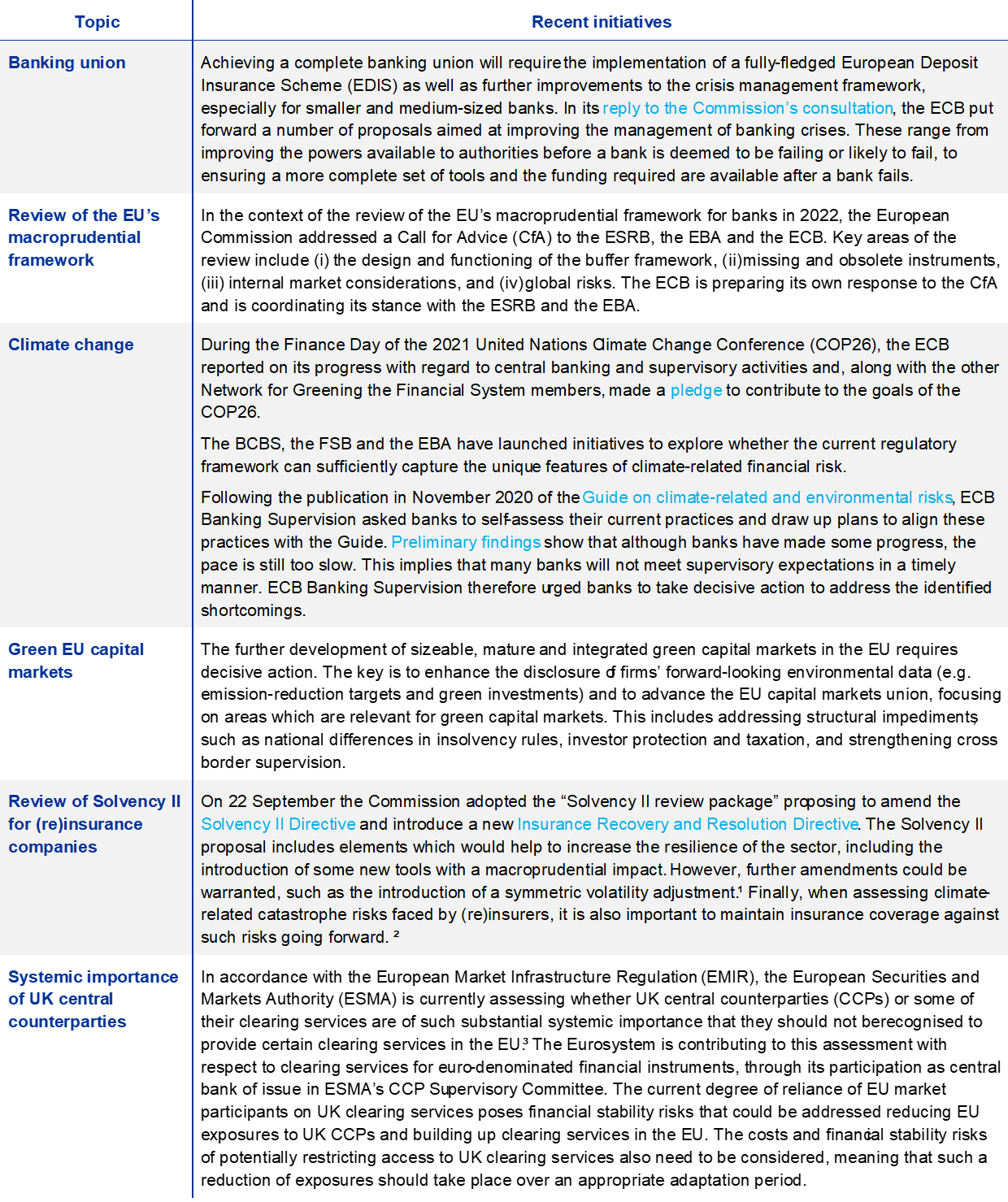

I always deposit my money into at least two (2) different. The federal reserve monitors risks to the financial system and works, usually with agencies at home and abroad, to help ensure the system. An alphabetical list of all institutions in that state will display below.

If a bank has delayed financial reports. Otherwise, they have to communicate. Look for the file labeled 'all_reports_assets and.